16 Sep Financial Accounting Non-Trading Accounts

Content

The main objective of non-trading concerns is to provide goods or services that fulfill a social need. There is neither a profit motive nor an expectation of earning net income. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The stock items from trading activity are shown as current assets in the balance sheet. The profit or loss as a result of sale of a fixed asset should be shown as income or expenditure in the income and expenditure account.

In economic terms, it is an organisation that uses its surplus of the revenues to further achieve its ultimate objective, rather than distributing its income to the organization’s shareholders, leaders, or members. Nonprofits are tax exempt or charitable, meaning they do not pay income tax on the money that they receive for their organization. They can operate in religious, scientific, research, or educational settings. No, there are many private non-trading concerns which provide educational, medical, technical and social benefits to its members. For example – societies for the promotion of different arts and sports, hobby clubs, civil associations. Non-profit making organizations (or non-trading concerns) exist for the benefit of the community. They seek to provide public goods without trading to make a profit.

Financial Statements for Not-for-Profit organisations

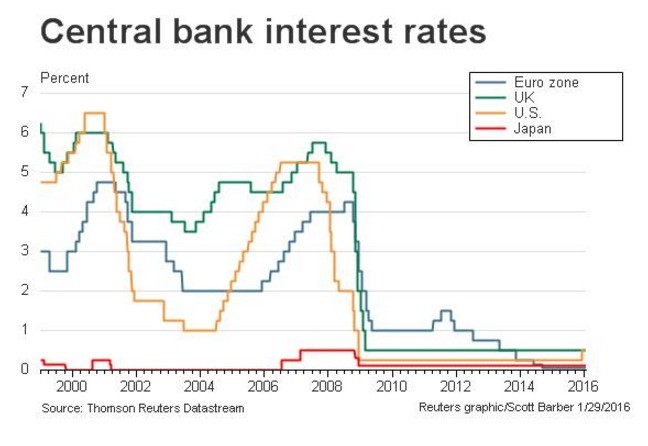

Thereare three time periods shown beginning with the year 1991 and ending in 2005. Your matched tutor provides personalized help according to your question details. Payment is made only after you have completed your 1-on-1 session and are satisfied with your session. The Income and Expenditure Account and a Balance Sheet are usually prepared with the help of a Receipt and Payment Account for Not-for-Profit Organisations.

SEC Commissioner Suggests Audited Financial Statement … – Thomson Reuters Tax & Accounting

SEC Commissioner Suggests Audited Financial Statement ….

Posted: Fri, 03 Feb 2023 16:19:39 GMT [source]

All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Receipts and payments of a capital nature or revenue nature are certain terms are included. These organisations are established to provide a service either at no cost or minimal cost for the advancement of society. The nature of the service varies from education to health to recreation. If the expenditure contains any sum of expenditure belonging to the preceding or subsequent year, it is deducted.

Profit-Making Organizations

All business transactions are first recorded in a journal. These final tallies are prepared for a specific period. The preparation of a final accounting is the last stage of the accounting cycle. It determines the financial position of the business. Under this, it is compulsory to make a trading account, the profit and loss account, and balance sheet.

- By using information from receipt and payment account and from other sources, the entity prepares its income and expenditure account and balance sheet at the end of the period.

- One of the basic accounting differences between a for-profit company and a nonprofit corporation derives from ownership.

- They usually only prepare and maintain a cash book to record receipts and payments made during the year.

- Trading concerns may take the form of a sole proprietorship, partnership, joint-stock company, or public enterprise.

For example, if a grant allocates $10,000 for an after-school dance program, a nonprofit can’t use that money to get new air conditioners for the main office without permission from the grantor. Receipts and Payments Accounts is basically a new name for your cash book. The format is basically similar to cash book, with FINAL ACCOUNTS OF NON-TRADING ORGANIZATIONS cash received being a debit entry and cash paid being a credit entry. The account records all the revenue items of the current period and at the bottom, it records deficit or surplus in the balance column. The funds or any surplus generated by such organisations are credited to the general fund or capital fund.

Accounting Treatment of Special Items of Non-trading Concerns

It is concerned with only revenue items—expenses and incomes. It records all losses and expenses on its debit side and all incomes and gains on its credit side. Cash Book consisting of entries of receipts and payments in a chronological order while the Receipts and payments is a summary of total cash receipts and cash payments.

How do you prepare a balance sheet for a nonprofit organization?

For a nonprofit balance sheet, you will use the equation: assets = liabilities + net assets (instead of owner's equity). Let's break this down into simpler terms. Note that our template shows the Statement of Financial Position with assets on the left, and liabilities and net assets on the right.

Some non trading organizations do carry out regular trading activity, but this is not the main purpose of the organization. Many clubs and societies have a café, a shop, a bar and so on, where goods are bought and sold. A trading account should be prepared for each trading activity in order to calculate the gross profit or loss earned. The gross profit or loss of a trading activity of a non trading concern is transferred to the income and expenditure account. If it is gross profit, it is shown as income and if it is gross loss, shown as expenditure in the income and expenditure account. The receipt and payment account follows the cash basis of accounting. It does not take into account whether the receipts and payments belong to the current period.

True & False Question With Answers On Accounts Of Non Trading Concerns

In this account, all losses and expenses relating to the period are debited and all gains and incomes relating to the same period are credited. It must be remembered that only the revenue items relating to the period are dealt within https://business-accounting.net/ this Account. All cash receipts are recorded on the debit side and all cash payments are recorded on the credit side. The basic principles for preparing the balance sheet of non-trading concerns are same as of trading concerns.

Accounting in Non-profit organisations relies on using the statement of financial position i.e., balance sheet along with the statement of activities like income statement and the statement of cash flow. The amount receipts from sale of newspapers, magazines and sport material is treated as revenue receipts and credit to income and expenditure account. Admission fees are paid by members only one at time of becoming a member. Hence, it is treated as a capital receipt by some organizations. Whether the entrance fees are to be treated as capital or revenue receipt, they are decided by the rules and regulations of the organizations. Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems.

At the end of the financial period, the balances of the accounts are calculated and mentioned in the worksheet as an item for making financial reports. Adjustments in the journals and closing journal entries are also made within the trading company, as well as the making of a post-closing trial balance should be done as the final step in the accounting cycle. Whereas for non-trading concerns the basic sources of revenue are entrance fees, subscriptions, donations, government grants, municipal grants, etc. Non-trading concerns earn income from fees, subscriptions and donations. They do not receive income from the sale of goods or services. The main sources of income for a non-trading concern are donations, fees and government or municipal grants.

No Comments